Vestigo is proud to be part of IBM Cloud for Financial Services Ecosystem. This followed detailed discussions establishing market potential of Vestigo’s solution and the technological fit.

You can see IBM’s article regarding the vision for the cloud ecosystem below.

IBM developed the IBM Cloud for Financial Services to help institutions balance the need to modernize with the industry’s security and regulatory requirements.

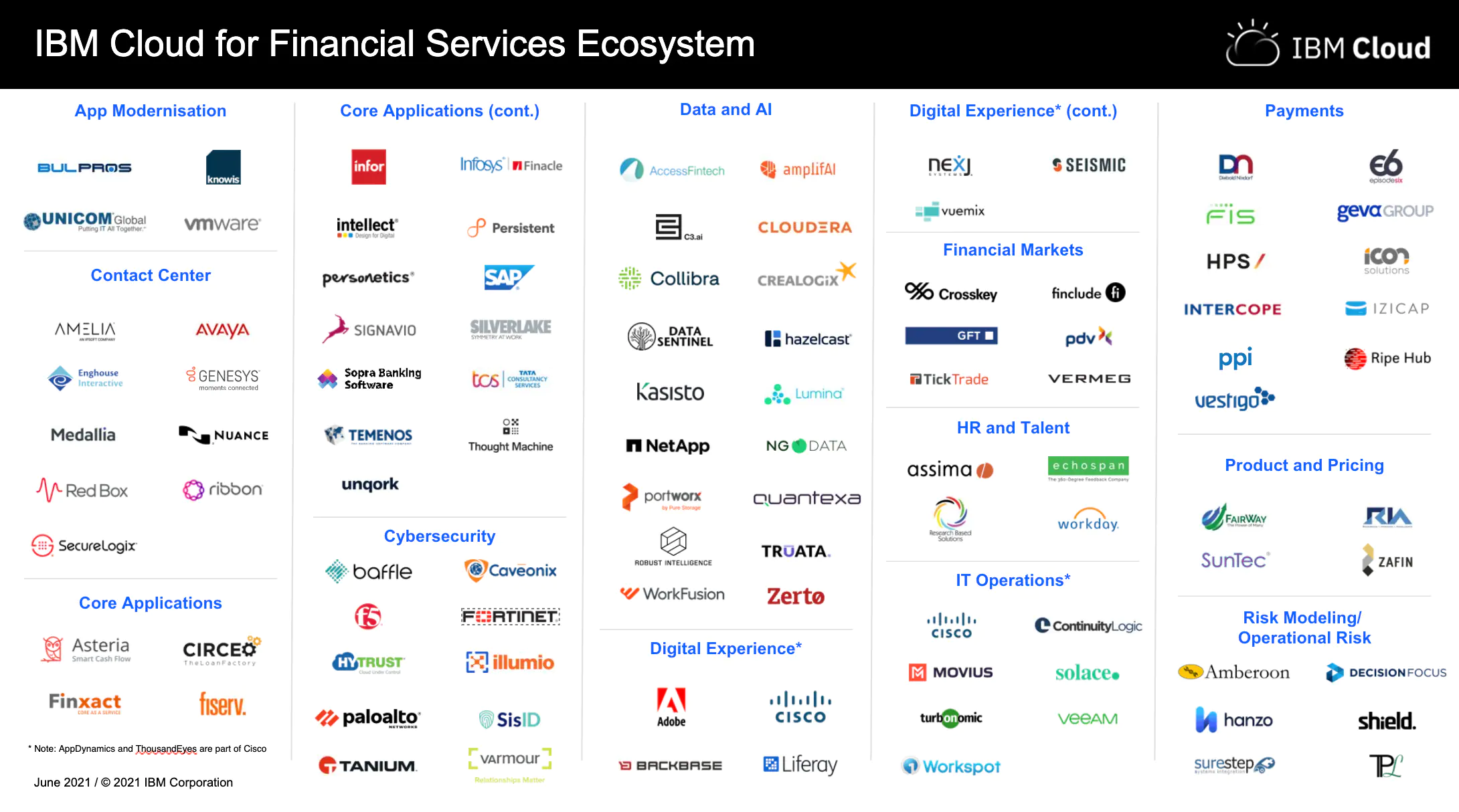

Nearly one year after we introduced partners to the world’s first financial services-ready cloud, we’re pleased to announce that the platform is now backed by more than 100 ecosystem partners that committed to help customers accelerate cloud adoption and digital transformation throughout the financial services industry.

A growing portion of the $1 trillion hybrid cloud market opportunity is comprised of the financial markets industry, which is expected to increase nearly 20% by 2024. [1] Key findings in a recent IBM internal analysis suggests that cloud is expected to account for about 60% of that future market opportunity as financial institutions are accelerating innovation to meet heightened customer expectations, deliver consistent services in the face of challenges like the global pandemic and navigate the ever-complex regulatory environment. [2]

We believe that can only happen if security and compliance controls are fully integrated into the platform from the onset. Otherwise, the likelihood of a large-scale data breach may increase dramatically as developers across the supply chain potentially develop and run applications on a cloud platform — or multiple clouds — that haven’t been properly configured nor adequately vetted for identity and access management.

Designed to reduce risk in the supply chain and unlock new revenue opportunities for partners

IBM Cloud for Financial Services is designed to help banks host mission-critical workloads while adhering to their security and compliance regulations. Using IBM’s fourth-generation confidential computing capabilities and “Keep Your Own Key” encryption delivered via IBM Cloud Hyper Protect Services, partners and their customers can retain control of their data and transact in a highly secured environment.

The IBM Cloud Framework for Financial Services is designed to reduce third- and fourth-party risk in the digital supply chain through a common set of security and compliance controls that are adhered to by the entire ecosystem. These built-in controls are engineered to help partners and customers accelerate innovation, unlock new revenue opportunities and decrease the cost of compliance while fostering a growing ecosystem. Ecosystem partners like NexJ Systems, Temenos, and Zafin use IBM Cloud Hyper Protect Services to free up expenses and employee resources dedicated to security and compliance. This helps them focus on creating new features, new functions and other product and service enhancements.

Enabling ecosystem partners to help speed cloud adoption in the financial services industry

Today, we reached an important benchmark — more than 100 ecosystem partners intend to onboard solutions onto the IBM Cloud for Financial Services to help financial services providers streamline the way they work with GSIs, ISVs, SaaS providers and FinTechs to help accelerate their innovation and improve the customer experience. Our focus is on enabling our partners to accelerate time to market and customer onboarding while deepening engagement through our security and compliance capabilities.

Customers can benefit from the growing ecosystem of partners supporting the IBM Cloud for Financial Services — which includes AmplifAI, Circeo, Decision Focus, Enghouse Interactive, Episode Six, Finclude, Hanzo Archives, Inc, Infosys Finacle, NetApp, Inc, NexJ Systems, Inc, NGDATA, Palo Alto Networks, Portworx by Pure Storage, SIS-ID, SunTec, Temenos, Vestigo, VMware, Zafin and many others — that can help financial institutions integrate offerings from third-party providers, modernize legacy applications to improve the customer experience and speed the path to market.

Supported by a Cloud Engagement Fund established as part of a $1B investment in our ecosystem, IBM helps our partners accelerate adoption of the IBM Cloud for Financial Services by addressing financial and technical obstacles that can hinder innovation. The fund offers IBM the ability to modernize applications through technology support and build new use cases, solutions and go-to-market collaborations while layering in cloud credits and technical resources to help partners launch impactful business relationships.

As our momentum increases, so will the benefits for customers. Our growing ecosystem has been used by customers to further streamline operations, increase efficiencies, reduce risk, decrease compliance costs and accelerate revenue growth as more partners continue to onboard. We’re speeding cloud adoption in the financial services industry by offering a cloud with a built-in security and regulatory framework that helps partners and their customers accelerate their journeys to the cloud. We’re proud to share that our momentum toward this goal is increasing every day.